We believe with knowledge comes confidence. So we’ve assembled a collection of timely information and expert market commentary designed to give you new insight into the ever-evolving financial marketplace to help you build the confidence that comes from being a knowledgeable investor. Bookmark this page and check back for regular updates.

Klingman Insights

May 16, 2022

The volatility in the equity markets over the last few months has certainly been disconcerting. At its intraday low yesterday, the S&P 500 was down 19.8% from its high on January 4th, just shy of an official “bear market” decline of 20% or more. In our January Capital Markets Outlook call we discussed many of the reasons for this year's market volatility: the Federal Reserve aggressively raising interest rates in response to inflationary pressures; continued uncertainty over supply-side issues and the Russian invasion of Ukraine; and lingering effects of Covid lockdowns, particularly in China. In reality, many other assets have already entered a bear market including technology stocks (NASDAQ Index down ~30%), US Small Cap Stocks (Russell 2000 Index down ~30%), cryptocurrencies (Bitcoin down ~55%), among others.

At times like these, we do think it is important to keep a proper historical perspective by studying and reviewing past market declines. History never repeats itself, but it often rhymes.

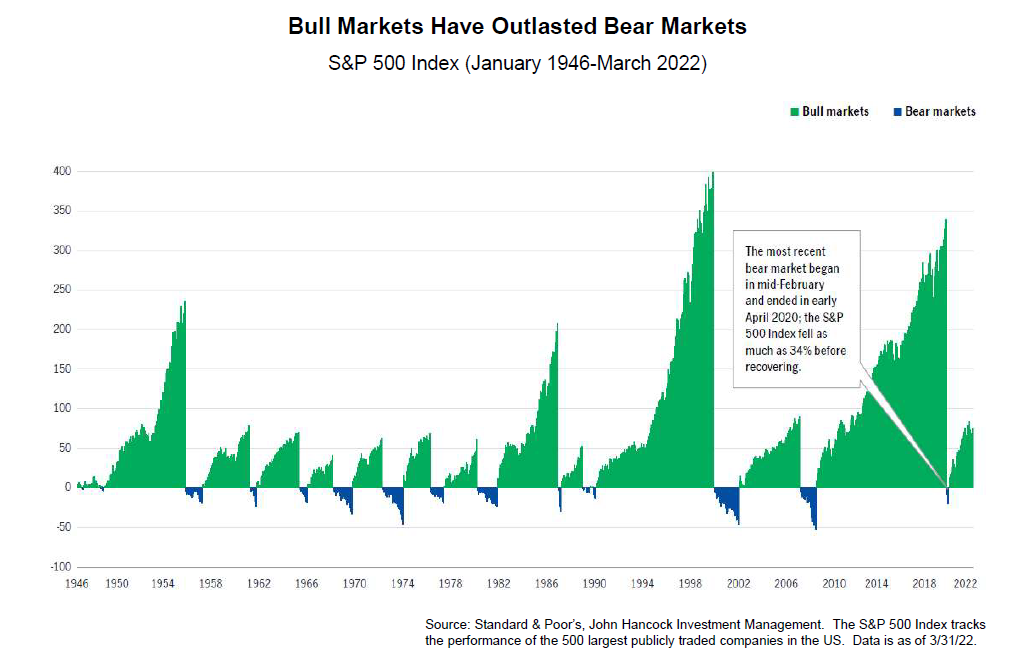

As you can see in the table below, there have been 11 bear markets, as measured by the S&P 500, post-World War II. On average, these bear markets lasted approximately 16 months and had an average decline of -35%. (We would note that we wrote a similar email in December 2018 when the Federal Reserve was raising interest rates and the S&P declined 19% from September through December 2018 before rebounding. Not quite a bear market, but close!)

|

Market Correction |

Market Peak |

Bear Market Return |

Bear Market Duration (Months) |

|

Post WWII Crash - Post-war demobilization, recession fears |

May 1946 |

-30% |

36 |

|

Eisenhower Recession - Worldwide recession |

August 1956 |

-22% |

14 |

|

Flash Crash of 1962 - Flash crash, Cuban Missile Crisis |

December 1961 |

-28% |

6 |

|

1966 Financial Crisis - Credit crunch |

February 1966 |

-22% |

7 |

|

Tech Crash of 1970 - Economic overheating, civil unrest |

November 1968 |

-36% |

17 |

|

Stagflation - OPEC oil embargo |

January 1973 |

-48% |

20 |

|

Volcker Tightening - Whip Inflation Now |

November 1980 |

-27% |

20 |

|

1987 Crash - Program trading, overheating markets |

August 1987 |

-34% |

3 |

|

Tech Bubble - Extreme valuations, .com boom/bust |

March 2000 |

-49% |

30 |

|

Global Financial Crisis - Leverage/housing, Lehman collapse |

October 2007 |

-57% |

17 |

|

Global Slowdown - COVID-19, oil price war |

February 2020 |

-34% |

1 |

|

Averages |

-35% |

16 |

Source: FactSet, NBER, Robert Shiller, Standard & Poor's, JPMorgan Asset Management.

The two most recent bear markets that we all remember well were the 2008-09 financial crisis, where equity prices fell 57%, and the 2020 Covid lockdown recession, where prices declined 35%. While we are now 4 1/2 months and ~20% into this market decline, we feel the economic backdrop is significantly different than these two prior periods. Although it has slowed, economic growth remains strong. Unemployment is at historic lows and consumer balance sheets are very strong. Global companies have record amounts of cash on their balance sheets and are less leveraged than they have been in past years. Corporate earnings continue to impress, with reported first quarter earnings for the S&P 500 growing ~10% which was well above original expectations of ~4%. While the equity market may continue to be challenged in coming months, particularly as the Federal Reserve continues to aggressively raise interest rates, we believe most of the decline has already happened. At the current price-earnings ratio of about 16 times forward earnings, we believe equities represent compelling long-term value.

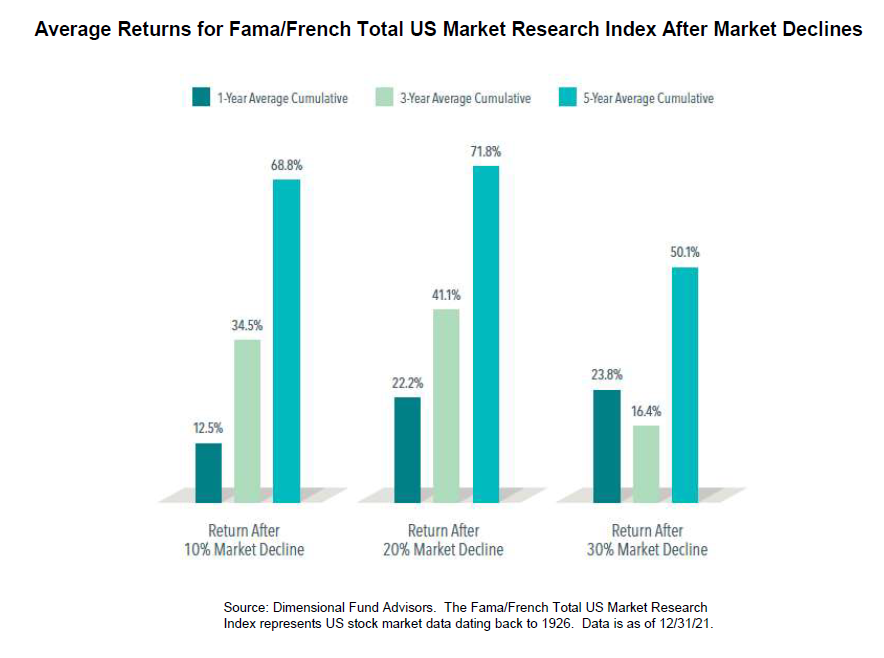

Although it is practically impossible to time the markets, there is a temptation during a bear market, when it appears equities decline almost every day, to just “sell” and “take a break.” Studies show this virtually never works because the first days of the turnaround out of a bear market provide some of the most vicious upside returns for stock prices. Missing these days has a strong negative effect on long-term investor returns. We firmly believe that patience and discipline are amongst the most important traits for successful long-term investing. As you can see from the two graphs below, patience has historically been rewarded as one, three, and five year returns after a 20% plus decline in the equity markets have historically been exceptional.