We believe with knowledge comes confidence. So we’ve assembled a collection of timely information and expert market commentary designed to give you new insight into the ever-evolving financial marketplace to help you build the confidence that comes from being a knowledgeable investor. Bookmark this page and check back for regular updates.

Klingman Insights

March 2, 2022

The last week has been extraordinarily difficult as the world has watched the unprovoked invasion of a free country and the unnecessary death, horror, and bloodshed it has caused. Our thoughts and prayers are with the people of the Ukraine and any of you with friends or family in that region.

While the imposition of economic sanctions from the US and the rest of the world was somewhat late in our opinion, they have been decisive and meaningful. Although there are still some loopholes that will allow Russia to continue limited banking operations and exportation of oil, in many ways their economy will now be completely decoupled from most of the rest of the world. Short of sending actual troops to defend Ukraine, we believe implementing these economic sanctions was the right thing to do.

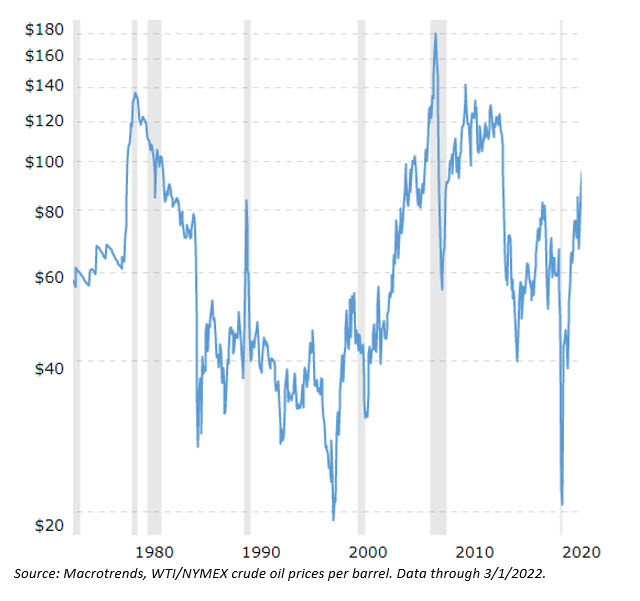

While the impact of these sanctions will be significant for the Russian economy, we do not believe they will be overly onerous on the global economy. Russia provides approximately 10% of the world's oil supply and a much higher percentage to Europe. Oil prices have already risen to $100 a barrel and we would not be surprised to see them rise another 10% to 20%. This and other potential commodity price increases would likely slow the global economy moderately, but not significantly. As you can see from the chart below, oil prices (measured by WTI and Brent), adjusted for inflation, are slightly above the average of the last 50 years, but still significantly below where they were in the late 70s, early 80s and most of the 2000's. Russia is the 11th largest economy in the world, but the combined GDP of Russia and the Ukraine make up only approximately 3% of global GDP. While we would not go as far as late Senator John McCain’s quote that “Russia is a gas station masquerading as a country”, it is just not that significant of an economy nor a meaningful trading partner for much of the world.

Meanwhile, economic statistics from the US economy continue to be very strong. GDP grew at a 7% rate last month and unemployment claims were at a 40 year low. We appear to be getting past the Omnicom variant and there's reason to believe that economic activity in the US will be strong for the coming year. We believe GDP will grow in the 3 to 4% range for 2022, slower than last year but still very strong. As we discussed in our Capital Markets Outlook, we believe the Federal Reserve is behind the curve in raising interest rates and reducing its balance sheet to help fight inflationary pressures. Markets imply that the Fed will raise interest rates slower than initially anticipated given this global crisis unfolding, but we still believe they have no choice but to tighten monetary policy to combat inflationary forces. We continue to position our fixed income portfolios to benefit from higher rates.

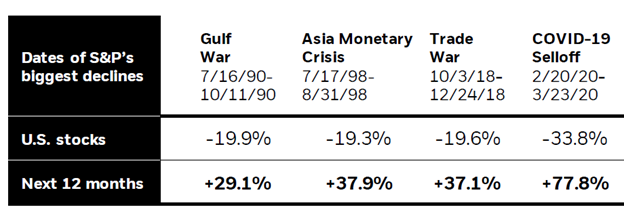

In our January Capital Markets Outlook, we highlighted the lack of volatility in the equity markets over the last 21 months. We fully anticipated more volatility in 2022 but did not foresee that that a military invasion would be the catalyst. The S&P 500 is now off about 10% from its January 4 ,2022 high. The chart below shows some other examples of geopolitical or economic events over the last 30 years that caused significant market disruption. Historically, reacting to geopolitical events that affect the stock market by selling equities has typically been a bad long-term decision in managing portfolios.

Earnings reports for US and global companies have generally continued to exceed expectations, although with some more conservative future guidance. At today's level, the S&P 500 is currently trading at about 18X our estimate of forward earnings, after trading as high as 22X forward earnings the beginning of 2021. At current prices we believe equities are attractive long-term investments despite the current crisis in Ukraine. Just as we did during the initial Covid crisis in February and March 2020, we continue to monitor, tax lost harvest and rebalance portfolios consistent with each client’s long-term target allocation.

As we offer these thoughts, we in no way suggest we have any idea how this crisis is going to end. Once a war starts there is unfortunately a very wide range of outcomes. We imagine that Putin thought this invasion would go much easier, and his range of choices right now are not appealing. We hope and pray for a peaceful outcome and that cooler heads in Moscow will somehow prevail.