We believe with knowledge comes confidence. So we’ve assembled a collection of timely information and expert market commentary designed to give you new insight into the ever-evolving financial marketplace to help you build the confidence that comes from being a knowledgeable investor. Bookmark this page and check back for regular updates.

Klingman Insights

March 8th, 2018

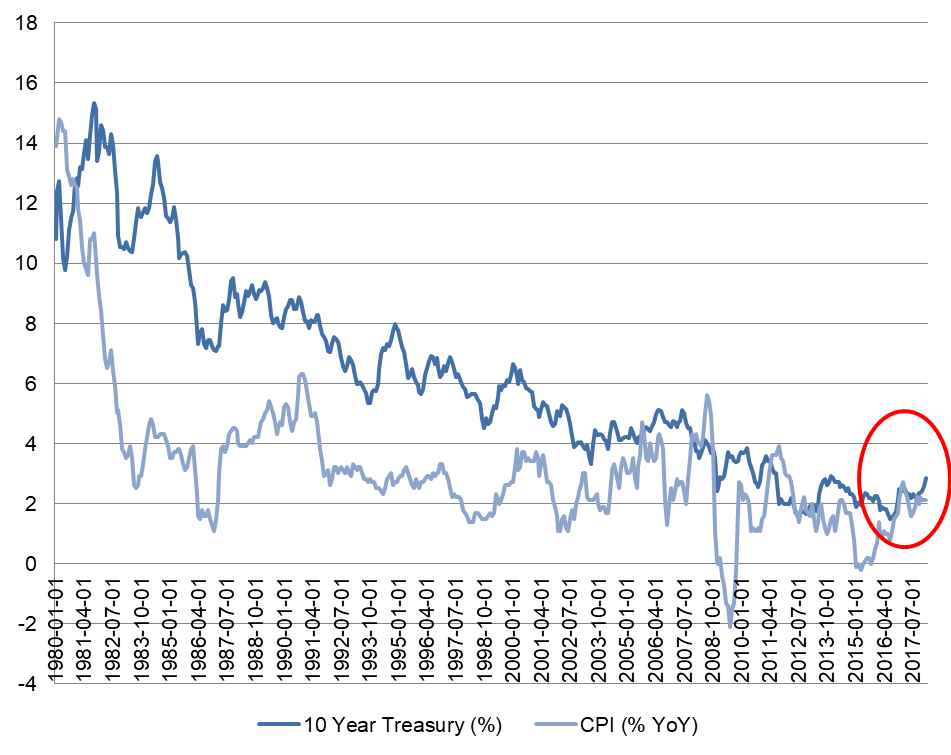

For a number of years we have been discussing the low interest rate environment and its potential (negative) implications for long term investors. With the 10 year US Treasury yield up nearly half a percentage point year to date and up one-and-a-half percentage points from July 2016’s all-time record low, it seems as if many others are now joining the conversation.

Short-term fluctuations like these are often “noise” amplified by the media. But we believe they may mark the end of the three decade period for the bond market that many have considered the greatest bull market in history. As seen in the chart below, long-term interest rates have steadily declined since the early 1980’s. While nominal yields did decline along with inflation, investors still enjoyed a positive “real” yield for many years. In recent years, however, real yields have declined (and at times have been negative). This perplexes us as long-term investors who do not see the value in lending money (buying bonds) to get less money back in the future when accounting for inflation.

Although rising interest rates typically cause the market value of bonds to fall, we view higher interest rates as an opportunity to boost long-term expected returns for client portfolios. To do so, we have shifted money from bonds to cash in our asset allocation models. We have also invested in much shorter duration bonds, which by definition are less impacted by changes in interest rates. So, in a rising rate environment like we believe we will continue to see, clients are well positioned to buy longer duration bonds at attractive prices and higher levels of income (yield).

Investing is the engine which drives financial plans forward. We have carefully serviced our engines and are prepared for the course ahead.

Source: St. Louis Fed. Data through February 2018.