We believe with knowledge comes confidence. So we’ve assembled a collection of timely information and expert market commentary designed to give you new insight into the ever-evolving financial marketplace to help you build the confidence that comes from being a knowledgeable investor. Bookmark this page and check back for regular updates.

Klingman Insights

January 10, 2019

The temptation for some investors in volatile times is to want to sell equities and “wait it out”. This stems from investors’ inability to convince themselves that things won’t get worse, or put another way, that things will get better. It has become even more challenging as investors are now bombarded by speculative articles, TV programs, blogs and tweets, all apparently telling them what is going to happen next. The truth is no one can accurately or consistently guess the direction the market will move. If you find someone with that crystal ball, we would love to meet them.

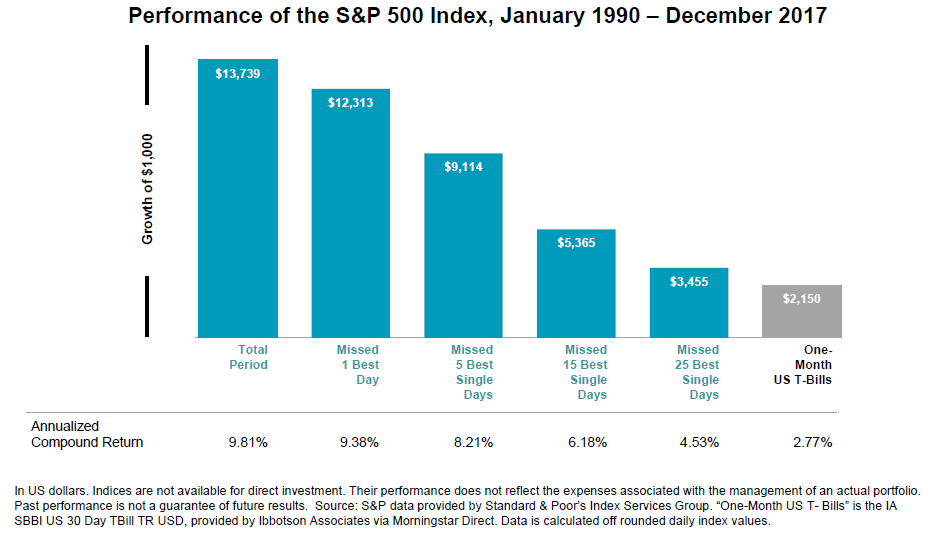

As studies by Vanguard and Dalbar, among others, have illustrated, and our experience has affirmed, individuals who “chase the trend” and significantly adjust their allocations in the short term put themselves at risk of not achieving their goals. Each market-timing call requires two correct decisions, not just one: when to get out of the market, and when to get back in. We point to Dimensional Funds research (shown below) to display the dangers of market timing. Over 27 years from 1990 to 2017, the S&P 500 returned nearly 10% annually. If you had missed the 15 best performing days during that period (which included over 6,800 trading days), your return would have been just 6.2%. Similarly, if you had missed the best 60 days, your return would have been negative.

The last several months have been challenging for long term investors as most asset classes have declined in value and volatility has increased. Patience is not only a virtue, but a required skill for the success of a long term investment plan. As we have often reiterated, we believe that remaining disciplined with your long term strategic allocations, harvesting tax losses and rebalancing portfolios as needed is the right thing to do.

Any opinions are those of Klingman & Associates, LLC and not necessarily those of RJFS or Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Diversification and asset allocation do not ensure a profit or protect against a loss. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.